PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

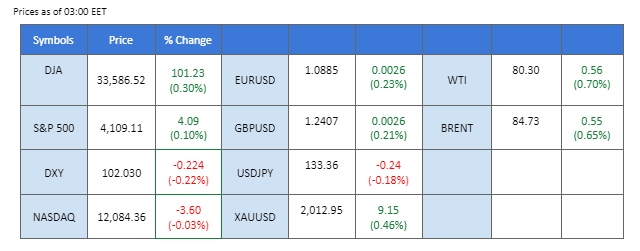

The market has a higher risk tolerance, with U.S. equity markets edging higher and the dollar extending its gain for the 2nd straight session. On the other hand, notwithstanding a dovish stance from the newly appointed BoJ governor, economists projected that the ultra-loose monetary policy is unsustainable with the rising inflation in Japan. Shifting from its current monetary policy toward a tighter approach will strengthen the Japanese Yen. Elsewhere, oil prices lack the momentum to trade higher, buoyed above $80 while waiting for clues from IEA and OPEC monthly reports.

Current rate hike bets on 3rd May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (29%) VS 25 bps (71%)

The US Dollar has maintained its upward trajectory, bolstered by Friday’s impressive jobs report and renewed speculation of a 25-basis point rate hike in May. Market participants are closely scrutinising the economic data to gauge the likelihood of a monetary policy shift by the Federal Reserve. This week’s focus will be on Wednesday’s release of US consumer price data, which is expected to show an uptick in inflation. Analysts are forecasting a 0.30% rise in headline inflation for March, while core inflation is predicted to increase by 0.40%. The release of this data can cause significant market volatility, and investors are advised to remain vigilant for potential trading opportunities.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 52, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 102.80, 103.40

Support level: 101.95, 100.85

Gold prices continue to extend their bearish momentum as the market braces for another potential interest rate hike by the Federal Reserve. The recent jobs report has intensified speculation of a 25-basis point increase in May, adding downward pressure on the precious metal. However, all eyes are on Wednesday’s release of US consumer price data, which is anticipated to reflect a rise in inflation. Analysts predict that headline inflation for March could increase by 0.30%, while core inflation may rise by 0.40%

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the commodity might extend its losses after successfully breakout since the RSI stays below the midline.

Resistance level: 2030.00, 2055.00

Support level: 2005.00, 1975.00

The euro has hammered down with a strengthened dollar with the dollar index gained an upside momentum along with the increase in treasury yield. Despite showing signs of easing in U.S. inflation and looming recession, the market expects an increase of 25 bps in the next interest rate decision. The CPI that is going to be released on Wednesday ( 12th April) is crucial to gauge the strength of the U.S. dollar and the price movement of EUR/USD.

The trading volume for the pair has been low lately, with narrow price volatility as investors are waiting for clues to trade. The RSI is moving in a downtrend, suggesting a weakening in momentum and the MACD is breaking below the zero line.

Resistance level: 1.0917, 1.0965

Support level: 1.0867, 1.0796

The Japanese Yen tumbled after the newly appointed governor of the Bank of Japan (BoJ), Kazuo Ueda, reiterated the central bank’s commitment to maintaining its ultra-loose monetary policy considering Japan’s ongoing economic challenges. Speaking to reporters, Ueda highlighted the country’s continued struggle to achieve its 2% inflation target, adding that he would be cautious about prematurely dialling back the BoJ’s massive stimulus efforts

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the pair might enter overbought territory.

Resistance level: 133.65, 135.40

Support level: 130.95, 128.30

The pound dropped 0.24% to $1.2432 on Monday as concern over potential rate hikes prompted the dollar to strengthen. The pair have been struggling to find direction since late last week. CPI data from the U.S. will be the next catalyst for GBP/USD. According to the CME Group FedWatch Tool, markets are currently pricing in 70% of the Federal Reserve, hiking its policy rate by 25 basis points at the next monetary policy meeting. Therefore, investors are now more likely to invest in the dollar rather than the pound, prompting a slight drop in the pound’s value.

As for now, investors are advised to focus on the upcoming CPI data for further trading clues. MACD is crossing down to the zero line, indicating a beginning of bearish momentum. RSI is at 47, indicating the pair might enter bearish momentum ahead.

Resistance level: 1.2425, 1.2613

Support level: 1.2298, 1.2190

The Dow Jones Industrial Average appears to be languishing in a lacklustre trading range, following a holiday-abridged trading week that left investors somewhat underwhelmed. As the new week dawns, all eyes are on the upcoming inflation data set to release on Wednesday, with analysts anticipating an uptick of 0.40% month-over-month and 5.6% year-over-year for core inflation. Against this backdrop, the much-anticipated FOMC meeting minutes are also slated to be unveiled on Wednesday, with savvy investors on the lookout for any hints about the Fed’s plans for tightening credit in the wake of the recent banking crisis.

The Dow is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 61, suggesting the index might extend its gains toward resistance level.

Resistance level: 34265.00, 35770.00

Support level: 32650.00, 31435.00

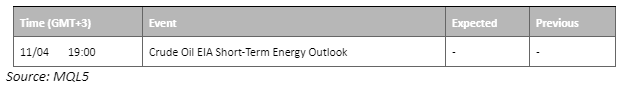

Oil prices dropped on Monday as concerns over potential interest rate hikes outweighed the positive effects of the OPEC+ decision to cut production. The U.S. dollar also strengthened after strong jobs data, increasing the likelihood of another Federal Reserve interest rate hike. It could make oil more expensive for non-dollar currency holders, potentially reducing demand and prices. Furthermore, this week’s trading activities are expected to be heavily influenced by inflation data, with the release of the CPI and PPI likely to rekindle concerns about rising inflation and the potential for higher interest rates in the near future.

Oil prices edge slightly lower and now trading below $80 per barrel as of writing. Before the U.S. inflation data is released, we expect the prices to hover between $77 to $81 per barrel. MACD has illustrated bullish momentum ahead. RSI is at 51, indicating the pair is trading within bullish momentum.

Resistance level: 81.06, 85.45

Support level: 77.25, 73.80

以行业低点差和闪电般的执行速度交易外汇、指数、贵金属等。

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!