PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

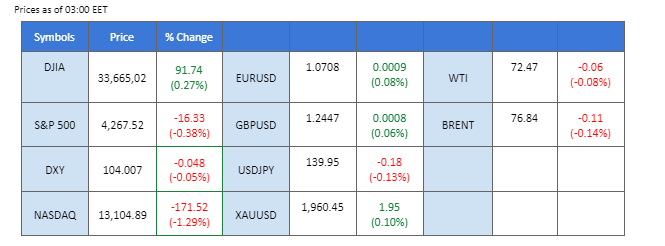

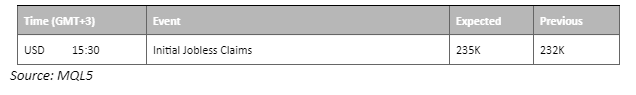

Despite the prevailing risk of an economic downturn in Australia, the RBA surprised the market by adding another 25 bps to its interest rate, vowing to bring the inflation rate down to 2%. The Canadian central bank followed the footstep of RBA and added 25 bps to its interest rate, causing the Canadian dollar to continue strengthening against the U.S. dollar. These developments have created pressure on other central banks to consider raising their interest rates, particularly the Federal Reserve, which had initially intended to pause rate hikes in the current month. In addition, oil prices experienced a 1% gain last night, driven by a surprising decline in U.S. crude oil inventories, indicating a better-than-expected demand for crude oil.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (66%) VS 25 bps (34%)

Rising short-term US Treasury yields boosted market demand for the US Dollar. Following the series of rate hikes by central banks worldwide, investors have begun to reevaluate the likelihood of the Federal Reserve following a similar path. As a result, short-term Treasury yields in the United States have experienced a significant rise, reaching 4.75%. This upward movement suggests that institutional investors are starting to anticipate the possibility of the Federal Reserve raising interest rates after its policy meeting next week.

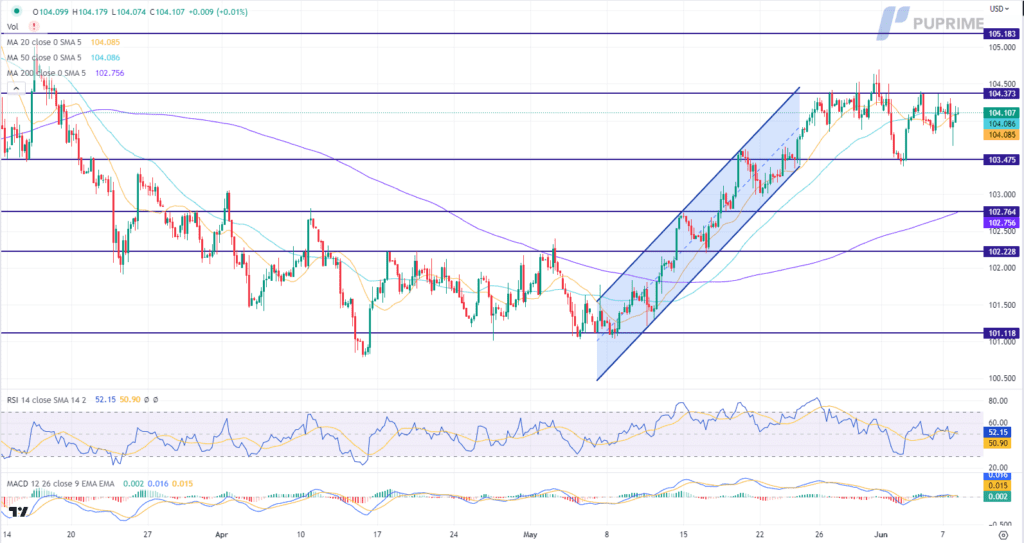

The dollar index is trading higher while currently near the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 52, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 104.35, 105.20

Support level: 103.45, 102.75

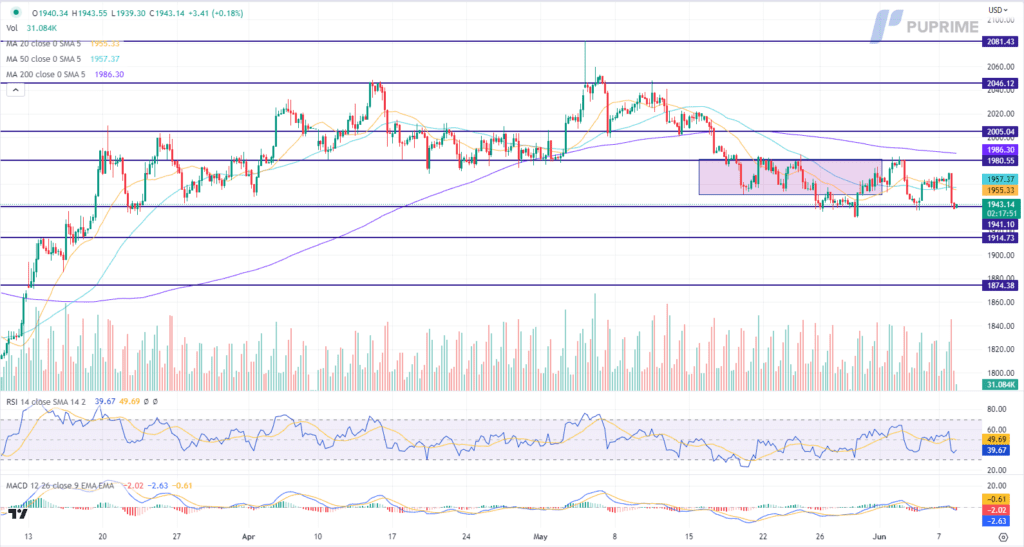

The reassessment of interest rate expectations and the evolving market sentiment have impacted on the price of gold, leading to a decline in its value. As central banks such as Australia and Canada raised their interest rates, investors have started to shift away from non-yield commodities like gold and instead seek safe-haven assets with higher risk-free returns, such as government bonds.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 1980.00, 2005.00

Support level: 1940.00, 1915.00

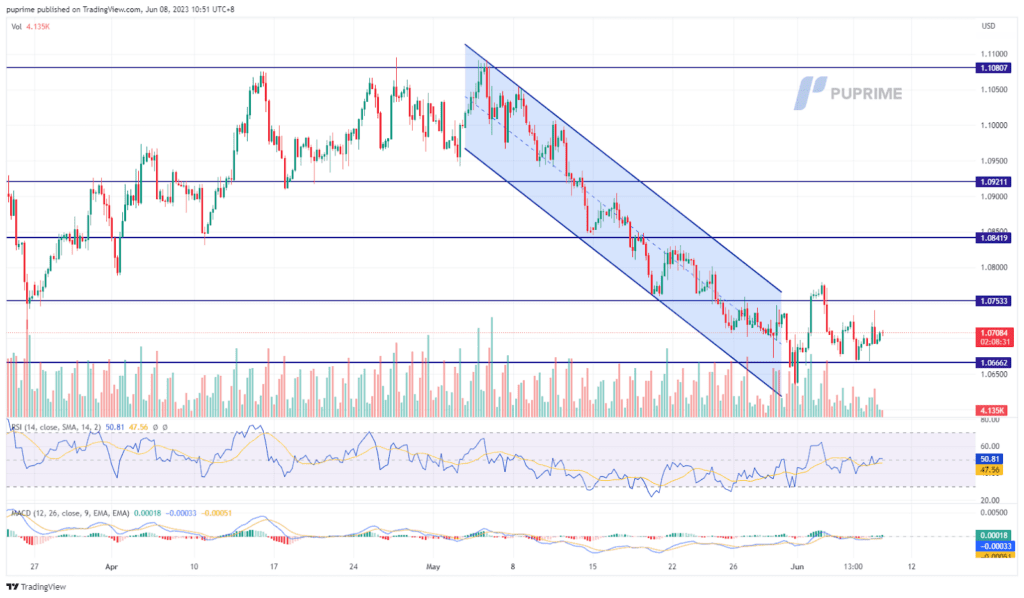

The pair continues to trade in a narrow range waiting for a catalyst to spur the price movement of the pair. Next week, the U.S. will announce its CPI reading; perhaps it may have an impact on the USD despite the Fed having a plan to pause its rate hike this month. In addition, the ECB will announce its interest rate decision next week with the market widely believing that the ECB will raise another 25 bps to its interest rate.

The price movement of EUR/USD has been trading in between 1.0723 to 1.067. The pair trades out of the downtrend channel and the RSI has been hovering near the 50-level while the MACD flows near to the zero line suggests a trend reversal for the pair.

Resistance level: 1.0753, 1.0840

Support level: 1.0666, 1.0586

In a surprising move, the Bank of Canada raised its overnight interest rates by 25 basis points to 4.75%, reaching the highest level since 2001. This decision caught the market off guard, coming on the heels of Australia’s central bank’s announcement of its 12th rate hike in just over a year, defying expectations once again. The unexpected actions by these central banks have introduced a new dynamic to the global monetary landscape, challenging previous assumptions and prompting investors to reassess their outlook on interest rate trajectories.

USD/CAD is trading lower while currently near the support level. MACD has illustrated diminishing bullish momentum. However, RSI is at 31, suggesting the pair might enter oversold territory.

Resistance level: 1.3325, 1.3445

Support level: 1.3325, 1.3270

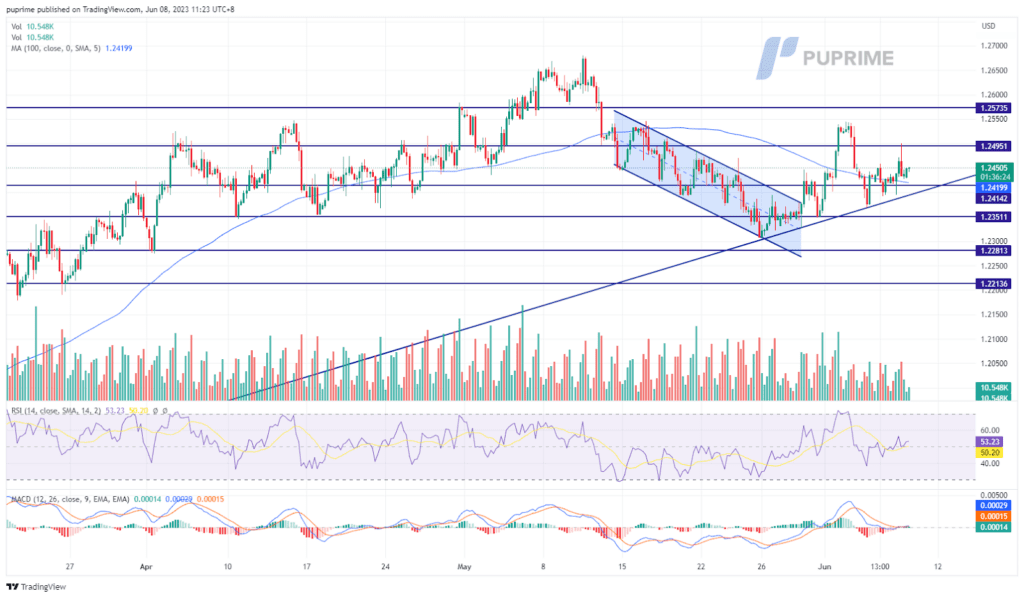

Cable continues to edge higher despite the USD having gained some strength, although the market is still uncertain of the following monetary moves from the Fed. The overall better-than-expected June economic data for the UK is convincing to speculate that the BoE will continue to raise its interest rate in June. The Fed will announce its interest rate next week while the BoE will announce the following week after the Fed’s announcement.

The cable is currently trading above its uptrend support line since its recent low in late May. The RSI and MACD indicators currently indicate a neutral momentum as of writing.

Resistance level: 1.2495, 1.2573

Support level: 1.2414, 1.2350

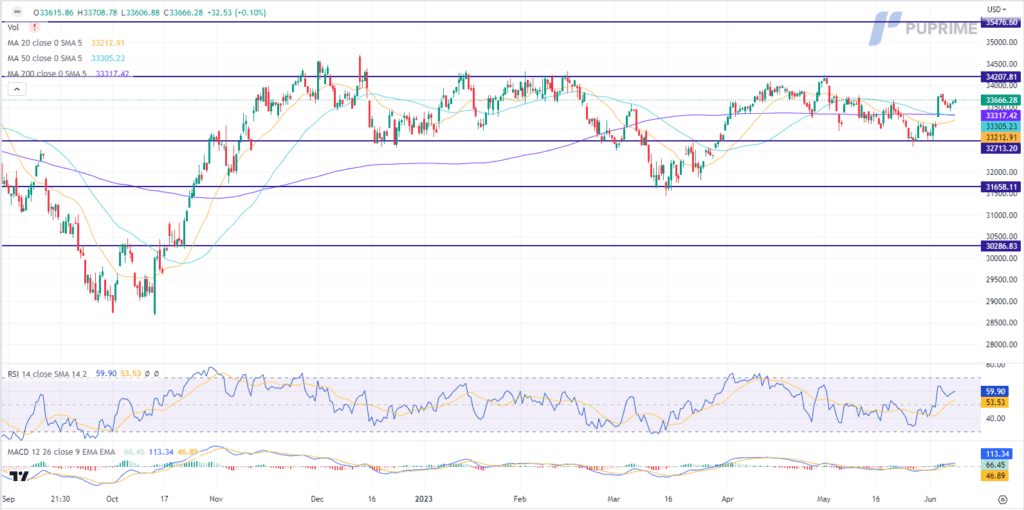

The Dow Jones Industrial Average struggled for direction yesterday as investors grappled with a mix of market sentiment and eagerly awaited updates from the Federal Reserve’s upcoming monetary meeting, as well as key inflation data. However, energy stocks emerged as the standout performers, driving broader market gains, as oil prices maintained their upward trajectory. This positive momentum in the energy sector was bolstered by Saudi Arabia’s recent move to reduce production and unexpected news on Wednesday revealing a decline in weekly US crude stockpiles. These developments injected optimism into the market, with investors closely monitoring the evolving dynamics of the oil market and their potential implications for broader economic trends.

The Dow is trading flat while currently near the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the index might extend its gains after successfully breakout since the RSI stays above the midline.

Resistance level: 34207, 35476

Support level: 32713, 31658

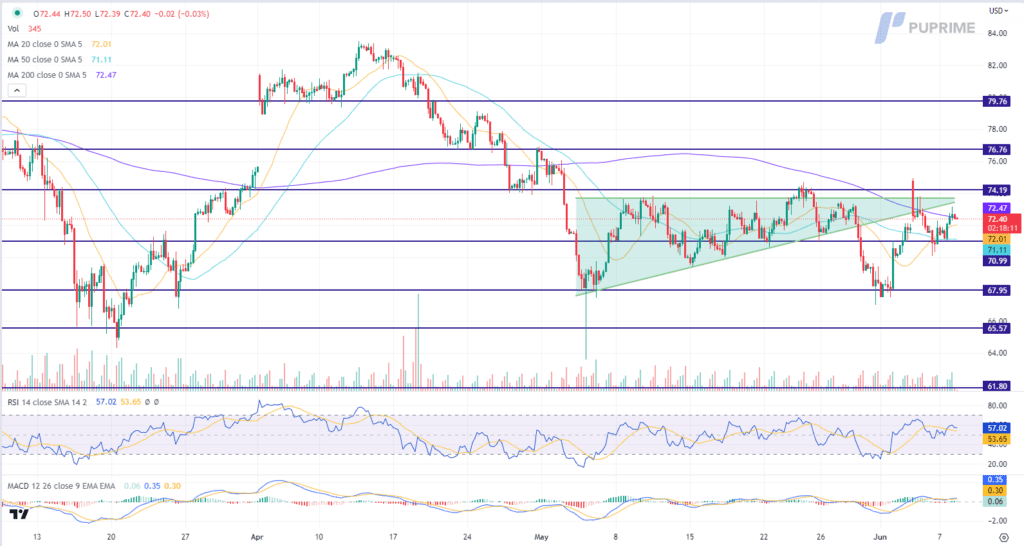

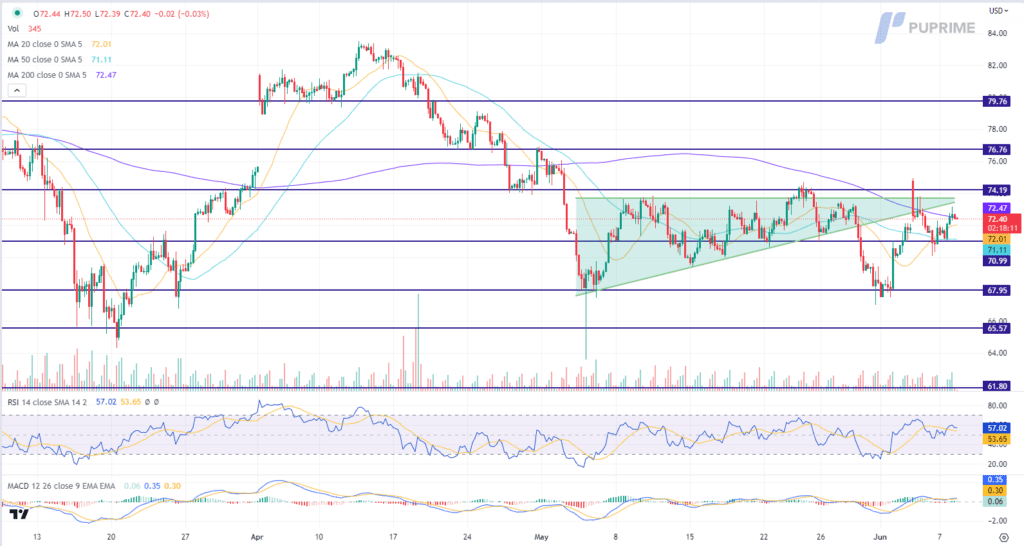

Oil prices remain locked in a consolidation phase, oscillating between key support and resistance levels as market sentiment remains mixed. The negative sentiment prevailing in the oil market stems from concerns over potential recession risks and the ongoing tightening cycle adopted by global central banks. Despite the prevailing headwinds, the oil market received a boost from encouraging inventory data, providing a glimmer of hope for investors. The latest figures from the Energy Information Administration (EIA) revealed a significant decline in US Crude Oil Inventories, falling from a previous reading of 4.488 million barrels to -0.451 million barrels. This sharp decrease in inventories surpassed market expectations of a more modest decline of 1.022 million barrels.

Oil prices are trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 53, suggesting the commodity might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 74.20, 76.75

Support level: 71.00, 67.95

以行业低点差和闪电般的执行速度交易外汇、指数、贵金属等。

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!