PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

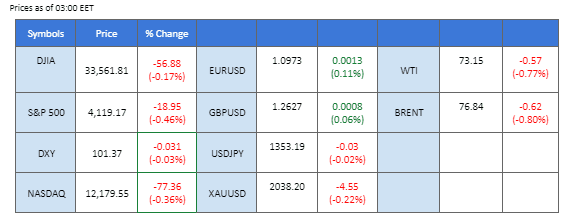

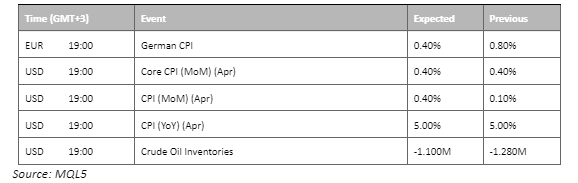

As investors await the U.S. Consumer Price Index (CPI) and monitor the development of the U.S. debt ceiling, the markets remain subdued. Most of the asset classes saw little change overnight ahead of the U.S. CPI, which is due to release later today (10th May). On the other hand, the market is looming with the U.S. debt default even as the President is in talks with the House Speaker. However, with both parties divided on the matter, progress remains elusive. Additionally, oil prices have surged by over 5% across the past three sessions, fueled by supply disruptions in Canada caused by wildfires that have impacted the supply by 500,000 barrels per day. Further contributing to upward momentum, the U.S. has announced an updated plan to refill its strategic petroleum reserve.

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (78.8%) VS 25 bps (21.2%)

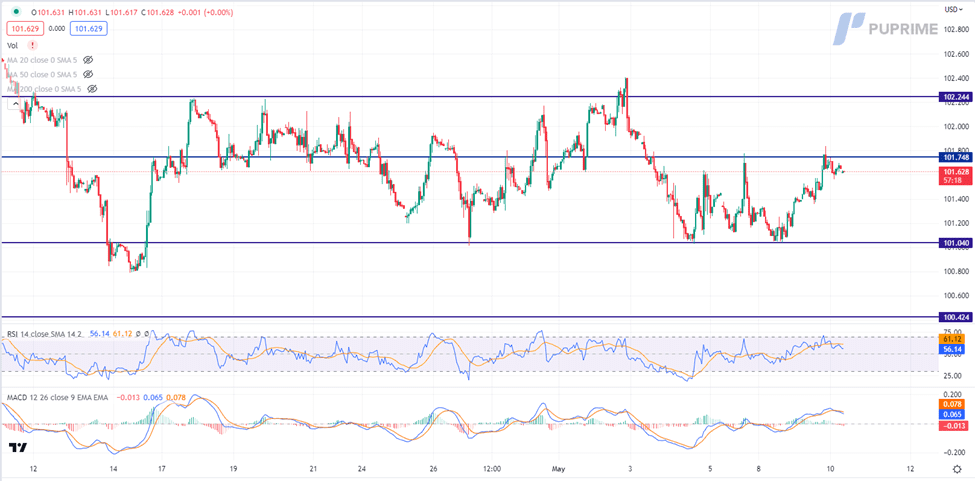

The US Dollar managed to edge higher against major currencies, buoyed by the rising short-term US Treasury yields. Heightened uncertainty surrounding the debt ceiling impasse prompted investors to aggressively sell off short-term bonds, resulting in a substantial surge in the yield on 1-month Treasury bills. The yield skyrocketed by 23.8 basis points, peaking at 5.689%.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 56, suggesting the index might trade lower as technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 101.75, 102.25

Support level: 101.05, 100.40

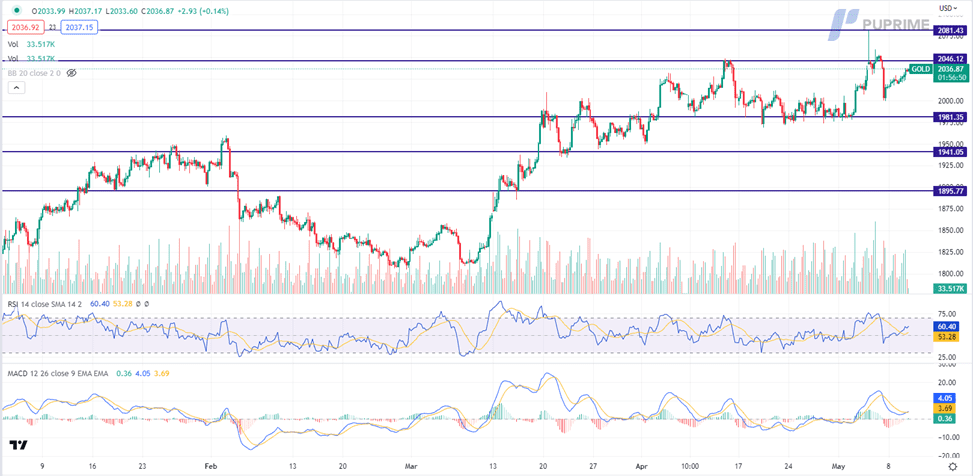

Amid mounting concerns surrounding the impending release of crucial data on US Consumer Prices, safe-haven gold extends its bullish momentum. Investors are growing increasingly anxious about the possibility of a government default as early as June 1st if Congress fails to reach a timely resolution. In this environment of uncertainty, gold, a traditional safe-haven asset, has emerged as a preferred choice for investors seeking to hedge to protect their portfolios from potential market volatility.

Gold prices are trading higher while currently near the resistance level. MACD has illustrated diminishing bearish momentum. RSI is at 60, suggesting the commodity might extend its gains after successfully breakout since the RSI stays above the midline.

Resistance level: 2045.00, 2080.00

Support level: 1980.00, 1940.00

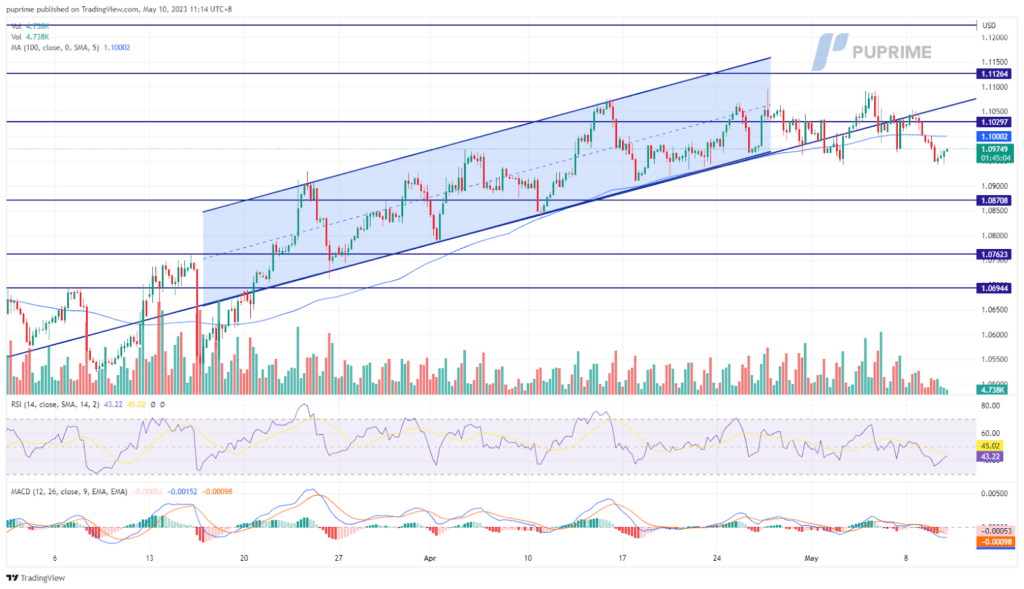

The euro continues to trade poorly against the U.S. Dollar, trading below 1.1000. ECB members continue to release hawkish statements speaking about further rate hikes; however, it does not stimulate the euro to trade higher. On the other hand, the U.S. CPI data is much anticipated and is due to be released today (10th May). The question for investors is if the CPI remains high, is the Fed still able to continue raising interest rates given that the banking turmoil is not resolved and the country is facing a debt default crisis?

The euro is trading stagnantly below 1.1000 and has fallen out of the uptrend channel. The RSI is moving toward the oversold zone while the MACD has broken below the zero line suggesting that the bearish momentum for the euro is building.

Resistance level: 1.1126, 1.1225

Support level: 1.0871, 1.0762

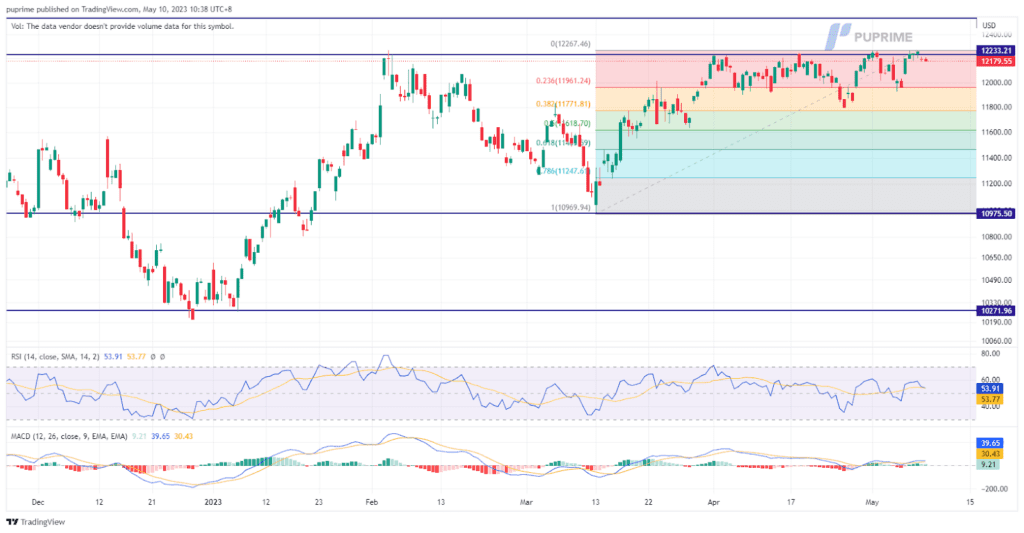

On Tuesday, the Nasdaq Composite declined by 0.63% to 12,179.55 due to concerns about U.S. inflation data and the ongoing negotiations regarding the U.S. debt ceiling. Traders were waiting for an update on plans for the debt ceiling from a meeting between President Joe Biden, Republican House Speaker Kevin McCarthy, and other congressional leaders at the White House. Anxiety persists as a potential government default looms over Washington as early as June 1 if Congress fails to resolve the deadlock. PayPal Holdings (PYPL.O) was among the top drags on the Nasdaq after the company cut its margin forecast.

The Nasdaq is still trading near its previous high of 12,264 points, and technical indicators such as RSI and MACD indicate bullish sentiment. Investors are advised to monitor the market for a potential breakout above this level.

Resistance level: 12264, 12536

Support level: 11961, 11771

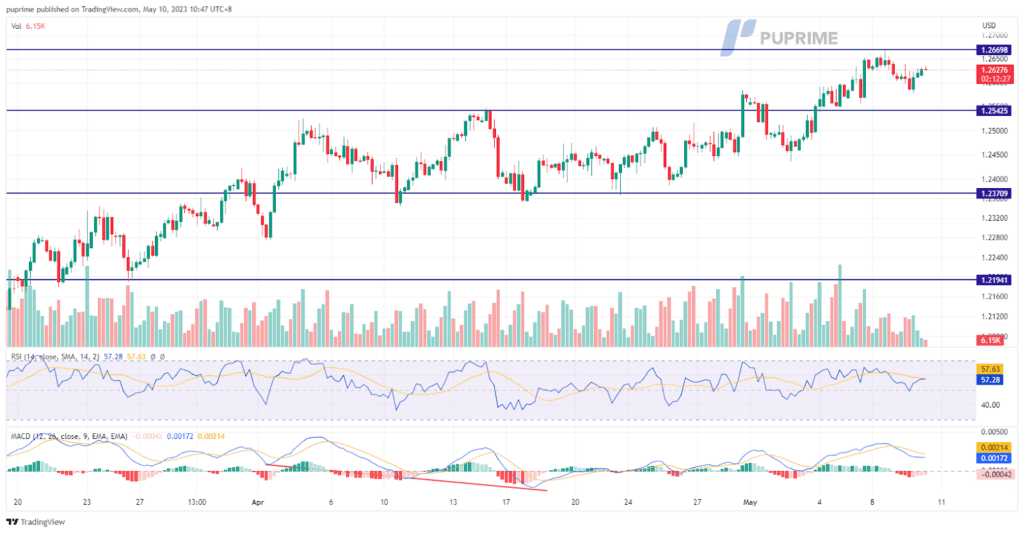

The pound eased slightly to $1.2628 against the U.S. dollar on Tuesday but remained near its one-year high, ahead of the Bank of England’s policy decision later in the week. The pound’s strong performance is due to stronger-than-expected economic data in the U.K., which has avoided a deep recession, and a weaker U.S. dollar dragged down by slower U.S. inflation and growing expectations that the Federal Reserve is nearing the end of its rate hiking cycle. The BoE has raised interest rates 11 times since December 2021 to combat double-digit inflation. Sterling is expected to rally if market-implied inflation forecasts do not show inflation falling below the 2% target over the medium term.

The pound’s overall trend remains strong, with RSI and MACD indicators signalling bullish momentum.

Resistance level: 1.2774, 1.2973

Support level: 1.2542, 1.2371

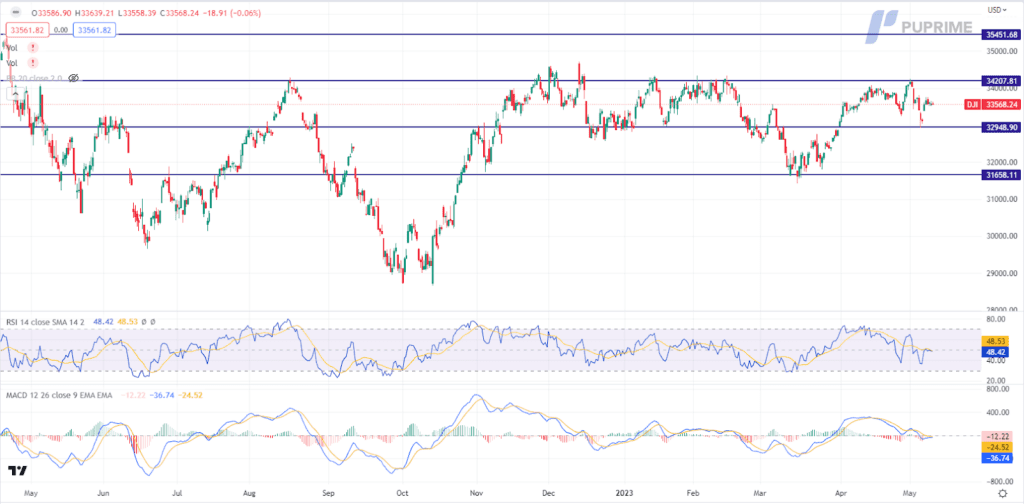

The Dow experienced a notable decline on Tuesday as mounting concerns ahead of the release of key data on US Consumer Prices cast a shadow over investor sentiment. Simultaneously, the impasse surrounding the US debt ceiling issue triggered a sharp sell-off in short-term Treasury yields, exacerbating market apprehension. Investors are increasingly fearful of a potential government default as early as June 1st if Congress fails to reach a resolution.

The Dow is trading flat following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 48, suggesting the index might continue to trade within a range as the RSI stays near the midline.

Resistance level: 34205.00, 35450.00

Support level: 32950.00, 31660.00

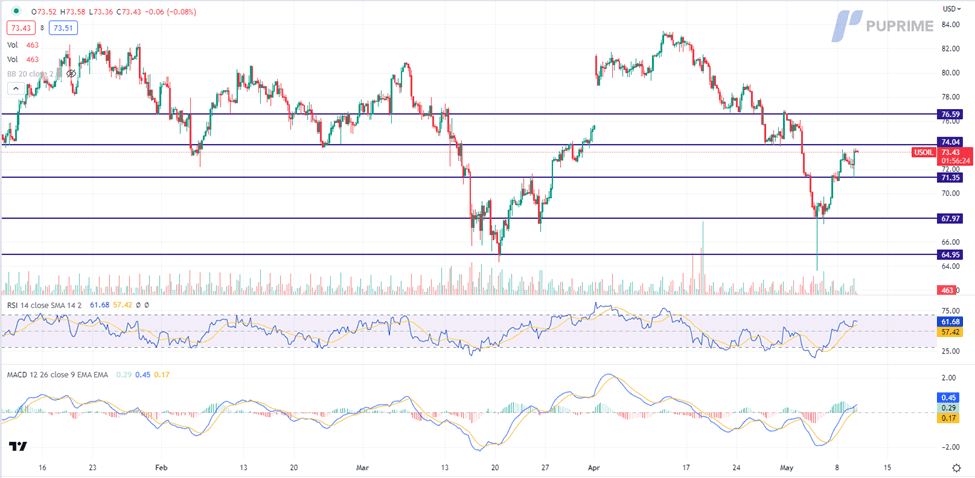

Crude oil prices experienced a notable surge following the release of a report by the Energy Information Administration (EIA), signalling higher seasonal demand and lower-than-anticipated output. The EIA’s Short-term Energy Outlook emphasised the expected increase in oil consumption during the seasonal upswing, coupled with a decline in OPEC crude oil production. These factors are projected to exert upward pressure on crude oil prices in the coming months, bolstering market sentiment.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the commodity might extend its gains after successfully breakout since the RSI stays above the midline.

Resistance level: 74.05, 76.60

Support level: 71.35, 67.95

以行业低点差和闪电般的执行速度交易外汇、指数、贵金属等。

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!